Finances

Yearly Budget

Each team will begin the season with an amount of cash comparable to the MLB luxury tax threshold,[1] plus any cash carried over from the previous year (subject to the LDB Luxury Tax). For purposes of LDB finances, a season begins when playoffs from the previous season end.

Luxury Tax

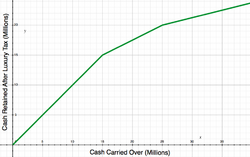

Any cash carried over from one season to the next not acquired in a trade is subject to the LDB luxury tax. However, the amount of cash acquired in trades not subject to the luxury tax is limited to the difference between the total amount of cash acquired and cash traded during the regular season. Cash carries over from one season to the next, and the luxury tax is assessed, when playoffs end and a new season begins. The luxury tax brackets are as follows:

| LDB Luxury Tax Brachets | |

|---|---|

| $0-15 million | No Tax |

| $15-25 million | 50% Tax |

| $25+ million | 75% Tax |

The tax rates are marginal, meaning that the first fifteen million is tax free, the ten million from $15-25 million is taxed at 50%, and only funds above $25 million are taxed at 75%.

Payroll

Payroll is tracked on a weekly basis. Teams will only pay players for the weeks during which they play for the team, except in cases where a player is dropped and clears waivers. Upon acquiring a player in trade or through waivers, the acquiring team will owe the player the balance of the player’s annual salary. If a player is acquired by waivers, the waiving team will no longer be responsible for the balance of the player’s annual salary.

Players signed as free agents during the season will be paid a prorated share of the league minimum, $500K.

- ↑ In 2016 the salary cap will be $189 M. For the 2017, 2018, and 2019 season, the salary cap will be $200 M. Before the 2019 season, the Commissioner will study whether to increase the salary cap for the 2020 season. Any subsequent changes to the salary cap will be announced a full season prior to the changes going into effect, and any changes will be in effect for a minimum of three LDB seasons.